The Belt and Road (B&R) Initiative is said to be a policy from the very top of the central leadership; it is comparable with the opening-up policy initiated by Deng Xiaoping in 1978. Within 30 years, the opening-up policy has helped transform China from a poor, underdeveloped country into the world's second-largest economy. From 1978 onward, after getting rid of the historical baggage of the "cultural revolution", China opened up to foreign investments. Waves of entrepreneurs came and built factories in various coastal cities, employing millions and exporting "Made in China" goods to markets worldwide. China has become the world's factory. For over 30 years since the opening-up policy was initiated, China's GDP has continuously witnessed double-digit growth. However, since 2012 China's economy growth started to slow down, with the government striving for growth of 8 percent; and growth has since remained at a single-digit level.

What is the problem? China exports a large chunk of its produce, mainly to Europe and the US. At times when Chinese supplies were fully consumed by these Western countries, there was no problem with China's economy at all. But after European economies were hit hard by the financial tsunami in 2008 and plagued by the Greek debt crisis, and the American economy was suffering badly from the aftermath of the subprime mortgage crisis, Western countries have been buying less from China. The country can no longer rely on exports to support its growth. Thus, it is necessary for China to explore new export opportunities with other countries and regions.

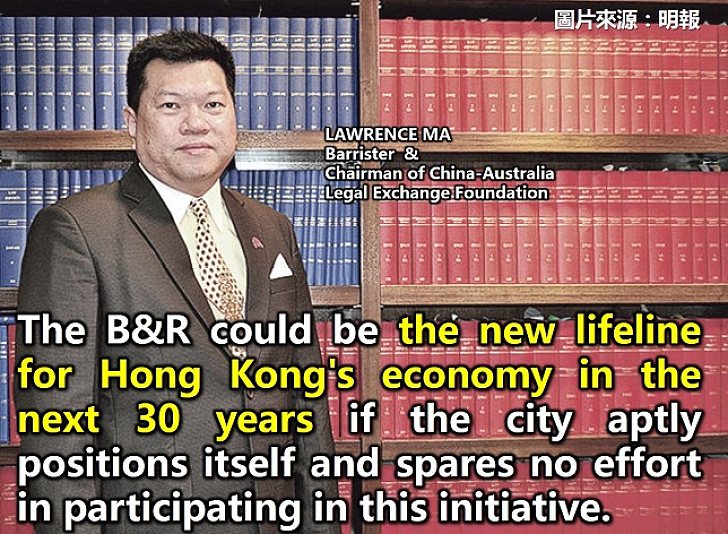

HK could find a new economic lifeline in B&R

On the international level, the world economy is stagnant and needs to find ways to boost growth. The only two densely populated regions in the world that remain underdeveloped are Africa and the middle Asia, with only the latter being geographically linked to China. Tapping into these massive underdeveloped economies will provide the much-needed opportunity to drive global economic growth and every country can now participate in this endeavor by joining the China-led Asian Infrastructure Investment Bank (AIIB).

Hong Kong's role as the gateway to the Chinese mainland for the world has significantly diminished since the implementation of the opening-up policy as foreign investors can now deal directly with the mainland; with the construction of many new ports and container terminals on the mainland, many mainland export-import cargoes need not go through Hong Kong. Meanwhile, Hong Kong's stock exchange is no longer the favorite platform for mainland companies to go public as many of their top executives are educated overseas and have better understanding of foreign systems than their predecessors; and they can get their companies listed in New York or Luxemburg. Hong Kong undoubtedly has been marginalized along with the mainland's rapid development. Adding to these woes are Hong Kong's internal problems: The city is struggling to provide enough suitable jobs for its over 12,000 university graduates every year from its over 12 higher tertiary institutions; "localism" activists have repeatedly abused mainland tourists verbally and boorishly bullied them, and now the city's retail sector is suffering from a persistent slide in sales, and on track to see its worst year since 2003 when the SARS outbreak hit the city. Hong Kong desperately needs opportunities to boost growth.

Chief Executive Leung Chun-ying rightly pointed out in his 2016 Policy Address that Hong Kong is a platform for capital formation and financing as well as for professional and infrastructure services. Indeed, the city has three advantages - an impartial and trusted legal system, an efficient financial market and numerous skillful legal and financial professionals. Central Asian countries certainly will have more confidence in an independent legal institution to handle project disputes that they may have with the Chinese mainland. Hong Kong, by virtue of "One Country, Two Systems", has an independent judiciary and will provide protection to all parties. Hong Kong's lawyers are well trained in contract drafting, contract administration and dispute resolution. The AIIB and the investors of any infrastructure project can make use of Hong Kong's securities market to raise funds by issuing debenture; they can also list their companies on the Hong Kong Stock Exchange as an exit strategy to cash in investments.

The B&R could be the new lifeline for Hong Kong's economy in the next 30 years if the city aptly positions itself and spares no effort in participating in this initiative...

圖片來源:明報

評論